- Retirement Examined

- Posts

- Retirement Examined

Retirement Examined

5-Minutes of Breakthrough Secrets: Happy, Fulfilling Retirement

The weekly email that keeps you up to date on exciting Retirement topics in an enjoyable, entertaining way for free.

The Silent Financial Crisis: How Key Life Events Disproportionately Impact Women—and the Urgent Solutions They Need

by Eric Seyboldt, MBA

The Hidden Economic Disparity: A Crisis in the Making

In the grand chessboard of financial security, women have long played at a disadvantage. Structural inequalities, compounded by deeply ingrained social norms, have created an economic landscape where key life events—marriage, divorce, widowhood—strike with disproportionate force. While economic hardship knows no gender, women face an entirely different financial calculus than men, one riddled with systemic challenges that threaten their long-term stability. The result? A silent financial crisis that is robbing millions of women of the security they deserve.

This crisis does not unfold in dramatic stock market crashes or headline-grabbing recessions. Instead, it seeps insidiously into everyday lives—through lower lifetime earnings, reduced retirement savings, and financial instability triggered by the loss of a spouse. Without targeted financial strategies designed to address these unique vulnerabilities, millions of women will remain trapped in a cycle of financial precarity, unable to secure the future they have worked so hard to build.

The Divorce Wealth Gap: Rebuilding Financial Independence

Divorce is often cited as one of life’s most emotionally and financially disruptive events. Yet, while both parties experience financial strain, the impact on women is often more severe and long-lasting. Studies have repeatedly shown that a woman’s household income, on average, drops by nearly 41% post-divorce, compared to 23% for men. This discrepancy is largely attributed to gendered labor force participation, caregiving responsibilities, and, in many cases, an over-reliance on spousal income.

The financial playbook for post-divorce recovery must be rewritten with a woman's unique challenges in mind. Essential strategies include:

Aggressive Asset Protection: Women must shift their financial focus from short-term alimony or child support to long-term asset accumulation. Establishing independent retirement accounts, securing real estate holdings, and maximizing tax-efficient investments are critical.

Strategic Career Acceleration: Many women face employment gaps due to caregiving responsibilities. Targeted reskilling programs, professional networking, and accelerated workforce reintegration strategies are essential in narrowing the post-divorce income gap.

Cash Flow Optimization Tools: Utilizing automated budgeting software, liquid investments, and structured settlements can provide a steady stream of income post-divorce, ensuring financial resilience in the face of uncertainty.

Widowhood and the Wealth Shock: Preventing Long-Term Financial Devastation

The death of a spouse is not merely an emotional tragedy—it is an economic earthquake. Nearly 70% of widows experience a significant financial decline within two years of their spouse’s passing. The gender retirement gap, inadequate estate planning, and a lack of financial literacy among older women compound this devastation.

To prevent financial freefall, widows must employ structured financial stabilization strategies, including:

Immediate Liquidity Planning: Many widows face an immediate cash shortfall due to probate delays, frozen assets, and reduced household income. Short-term bridge financing solutions, life insurance payouts, and strategic asset liquidation can ensure uninterrupted financial security.

Long-Term Stability through Portfolio Reallocation: The typical widow inherits a portfolio designed for dual-income retirement. Shifting towards low-volatility, income-generating assets, such as dividend stocks, annuities, and municipal bonds, is critical for sustaining wealth.

Estate Planning for Financial Continuity: Women must demand more than just “in case of emergency” planning. Comprehensive estate strategies, including joint survivorship accounts, structured inheritances, and revocable living trusts, should be non-negotiable elements of financial planning.

A Call for Systemic Change: Closing the Gender Wealth Divide

The financial industry must acknowledge that traditional wealth management strategies fail to account for women’s unique economic realities. More than just empowerment seminars and generic financial literacy programs, women require targeted financial tools that reflect their distinct challenges. Financial advisors must recalibrate retirement models to address women’s longer life expectancies, employment gaps, and reduced earnings trajectories.

More than individual action, institutional shifts are required:

Corporate policies must support paid leave and childcare subsidies, allowing women to maintain career continuity.

Government policies must close the social security gender gap, ensuring that caregiving years do not result in poverty.

Financial products must be redesigned to reflect women’s risk profiles and wealth accumulation patterns, from widowhood survival strategies to gender-sensitive investment solutions.

Financial security is not just a matter of numbers on a balance sheet. It is a matter of dignity, autonomy, and justice. The time for change is now.

Reach out to us for a complimentary, 10-minute consultation call. Let's explore together how we can help you select the right Medicare Supplemental Plan, ensuring your golden years are as fulfilling and worry-free as you’ve always imagined. Give us a call today at 614-943-2265 to schedule your consultation. Let's make your retirement dreams a reality!

The Daily Newsletter for Intellectually Curious Readers

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

Can I Finally Retire!!?

by Eric Seyboldt, MBA

Client: "Eric, I’ve been saving for decades, watching the markets, and carefully planning. But with everything happening in the economy—rising inflation, market volatility, and Social Security uncertainty—how do I know when I can actually retire? I don’t want to work forever, but I can’t afford a mistake."

Eric: Ah, the defining question of the modern pre-retiree. When is “enough” truly enough? When can the daily grind be replaced with the long-awaited freedom of retirement? The answer isn’t a single magic number—it’s an intricate balance of economic forces, personal financial preparedness, and the unpredictable realities of longevity and policy risks.

The Five Critical Pillars of Retirement Readiness

THE MARKET FACTOR: CAN YOU WITHSTAND THE SEQUENCE OF RETURNS RISK?

Most pre-retirees fixate on their total savings, but that’s a trap. Retirement isn’t just about how much is saved but when the withdrawals begin. The sequence of returns risk—a devastating financial hazard—occurs when early retirement years coincide with a bear market. If a retiree begins withdrawing in a market downturn, portfolio depletion accelerates exponentially, making recovery nearly impossible.Solution? A buffer strategy: a combination of a cash reserve (2–3 years of expenses) and a dynamic withdrawal rate, ensuring that retirement isn’t dictated by short-term economic turbulence.

INFLATION: THE INVISIBLE RETIREMENT TAX

Many whitepapers underestimate the compounding effects of inflation. A retiree with a 30-year horizon must expect their cost of living to double, if not more. The official CPI understates true retiree inflation due to skyrocketing healthcare costs and housing expenses.Hedge? A balanced portfolio with inflation-sensitive assets—TIPS (Treasury Inflation-Protected Securities), real estate, and selective dividend-paying stocks. A static, bond-heavy allocation is a death sentence in an era of persistent inflation.

SOCIAL SECURITY: TIMING IS EVERYTHING

The conventional wisdom says, “Delay until 70 to maximize benefits.” But retirement strategy is rarely one-size-fits-all. The break-even point between taking Social Security at 62 vs. 70 is around age 80. If there’s a family history of longevity, delaying is a mathematical advantage. But for those in poorer health, claiming early might make more sense.Complication? Congress has a fiscal problem—Social Security’s trust fund is on track to face automatic benefit reductions within the next decade unless reforms occur. Future benefits are uncertain. Retirement must be planned assuming less government support, not more.

THE EXPENSE REALITY CHECK: DO YOU KNOW YOUR RETIREMENT NUMBER?

Many pre-retirees underestimate spending in their early retirement years. The so-called “go-go years” (ages 60-75) tend to be the most expensive, as travel, hobbies, and healthcare increase. The oft-cited 4% rule—spending 4% of retirement assets annually—is outdated.Instead, the best approach is a dynamic withdrawal strategy, where spending adjusts based on market conditions and personal health factors. This prevents running out of money in later years while allowing flexibility in the early years.

LONGEVITY AND HEALTHCARE: THE UNSEEN FINANCIAL LIABILITY

One of the greatest risks is outliving assets. With medical advancements, many retirees are living well into their 90s, but their portfolios aren’t structured for that longevity. Long-term care is the financial iceberg most fail to account for.The best safeguard? A combination of hybrid long-term care insurance and tax-advantaged accounts like HSAs (Health Savings Accounts) to cover medical expenses. Traditional insurance is often inadequate.

So, When Can You Retire?

The answer isn’t about an age. It’s about preparedness. Can your portfolio sustain the worst-case sequence of returns? Can your strategy withstand 30 years of inflation? Is your income insulated from policy risk? If the answer to all three is yes—retirement isn’t just possible, it’s optimal. If not, recalibration is required.

The Final Verdict

A successful retirement isn’t about stopping work. It’s about financial independence—where work becomes optional, not necessary. The mistake most retirees make? They see the finish line and sprint, rather than ensuring they have the resources to cross it securely. Retirement is not an event; it’s a carefully orchestrated financial masterpiece. And those who understand this? They don’t hope to retire. They know they can.

Contact us for a free, brief 10-minute consultation. Together, we can discuss ways to safeguard your wealth and ensure your retirement years are as enjoyable and stress-free as you've envisioned. To arrange a complimentary 10-minute consultation call us today at 614-943-2265. We're here to help turn your retirement aspirations into reality.

Fixed annuities can be an essential component of a well-rounded retirement strategy, offering security, predictability, and efficiency in financial planning.

These are current fixed annuity rates and their durations from Top A-rated carriers (subject to change at any time, not FDIC insured):

Rates Levelled Out! Don’t Wait To Lock These Fixed Annuity Rates In Today!

3-year: 5.10% (under $100k Deposited)

3-year: 5.25% (over $100k Deposited)

5-year: 5.30% (under $100k Deposited)

5-year: 5.45% (over $100k Deposited)

Please feel free to call Eric at 614-943-2265 if you’d like to ask any questions or request information on these fixed annuities or other retirement topics that are on your mind.

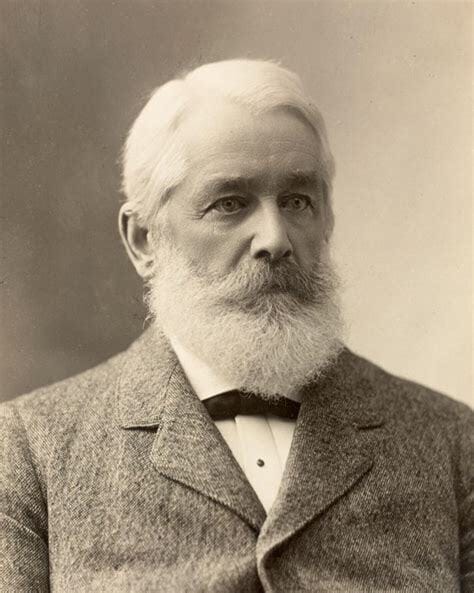

“The gratification of wealth is not found in mere possession or in lavish expenditure, but in its wise application.”

Edward Atkinson

REAL ASSETS, Invest Like the Ultra-Wealthy

Have You Considered Adding ‘Real Assets’ like Gold or Bourbon to Your Investment Portfolio?

In uncertain economic times, the savviest investors know one thing for sure: paper wealth can be fleeting, but real assets stand the test of time. That’s why tangible investments—like gold and even bourbon barrels—are gaining traction as a hedge against inflation and excessive currency production. These assets don’t just act as a financial fortress; they also bring valuable diversification to any portfolio, even when markets are steady.

History has proven that during economic turbulence, physical assets often outshine traditional investments, offering reliable protection when it matters most. Whether it’s the enduring value of precious metals or the appreciating allure of aged spirits, adding real assets to your strategy can be both a defensive and rewarding move.

As market uncertainties loom, now might be the perfect time to explore how these time-tested investments can fortify your financial future. Ready to learn more?

Allocating funds into the asset class known as “Real Assets” may be a strategy that you should consider.

Ask us how to Rollover a portion of Your IRA or 401k To A BOURBON IRA (www.bourbon.fund/how-it-works/) or a GOLD IRA (see link below) and:

Safeguard your assets from the collapsing dollar

Incorporate the ‘REAL ASSET’ class into your portfolio like the ultra-wealthy

Hedge against the current high-inflation conditions

Protect your retirement assets against economic crises

Just get in touch. We make it easier than ever.

CONNECT WITH US

Eric Seyboldt, MBA

Feedback or Questions?

You’re invited to get in touch with us if you’d like to find out how the Novus Financial Group can help you on your journey to a happy, fulfilling life in Retirement.

Office: 614-943-2265

Feel Free To Forward Retirement Examined To A Friend and Have Them Subscribe By Clicking The Button Below:

Reach out if you’d like to advertise your business on Retirement Examined or would like to be a sponsor.

Investment advisory services are offered by duly registered individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser.

The content we provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision. Also, note that every investment comes with its risks and drawbacks. Lastly, we would like to remind you that past results cannot guarantee future returns.

This website contains one affiliate link. When you click on the link and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers