- Retirement Examined

- Posts

- Retirement Examined

Retirement Examined

5-Minutes of Breakthrough Secrets: Happy, Fulfilling Retirement

The weekly email that keeps you up to date on exciting Retirement topics in an enjoyable, entertaining way for free.

How to Pay Zero Taxes on Capital Gains in Retirement

by Eric Seyboldt, MBA

Retirement planning often focuses on how to grow assets. But equally important is how to withdraw those assets efficiently, especially from taxable accounts. With the recent passage of the Big Beautiful Bill, retirees now have even more room to generate income through capital gains without owing federal tax.

Let’s take a closer look at how that works—and how real people can use it.

Who This Applies To

Many retirees have investments in taxable brokerage accounts. Maybe they built them up after maxing out their retirement plans. Maybe they inherited them. Either way, selling appreciated stocks, ETFs, or mutual funds in those accounts creates capital gains, which are taxed separately from other income, and often at lower rates.

What’s often missed is that retirees, who usually have lower taxable income than during their working years, are uniquely positioned to take advantage of the lowest possible capital gains tax rate: 0%.

What Changed: Two Key Updates in the New Law

Higher 0% Bracket for Capital Gains

Starting in 2025, the income thresholds for the 0% long-term capital gains rate have been increased:Single filers: up to $65,000

Married filing jointly: up to $130,000

Retirement Realization Window (RRW)

A new provision gives anyone aged 62 or older an additional $25,000 in long-term capital gains per year, taxed at 0%, regardless of income. It’s available for 10 years and doesn’t carry over—use it or lose it.

Example 1: James and Linda (Moderate-Income Retirees)

James and Linda are both 68. They draw $45,000 a year from IRAs and receive $35,000 in Social Security. Their adjusted taxable income comes out to $45,000.

They want to sell $40,000 of an old mutual fund holding to generate some extra cash. Under the new law:

Their income puts them under the $130,000 joint filer threshold.

The first $95,000 of capital gains (based on their total taxable income) qualifies for the 0% rate.

They also qualify for the $25,000 RRW exemption.

End result: They can sell up to $110,000 in appreciated assets this year and owe nothing in federal capital gains tax. Winning!!

Example 2: Susan (Higher-Income Retiree)

Susan is 64 and lives on a mix of rental income and pension payments totaling $120,000 a year. She doesn’t qualify for the standard 0% capital gains bracket. But she does qualify for the Retirement Realization Window.

She sells $25,000 worth of a highly appreciated ETF and, thanks to the RRW, pays zero tax on the gain, even though her total income is well into six figures.

Why This Matters

The ability to sell appreciated assets and realize gains tax-free opens doors: you can rebalance portfolios, raise your cost basis, gift assets more effectively, or simply create liquidity. And doing it early in retirement—before RMDs or large Social Security benefits kick in—makes the strategy even more useful.

Quick Reminder

Now, while I may have been teaching these strategies for the last 20 years, and I’m qualified to sit for the CPA exam, I’m not a CPA, and this shouldn’t be construed as personal tax advice. Check with your tax accountant for specific advice.

Reach out to us for a complimentary, 10-minute consultation call. Let's explore strategies to protect your wealth and make your retirement everything you've dreamed of—secure, fulfilling, and worry-free. Schedule a free 10-minute consultation today by calling 614-943-2265. Your future deserves the best plan, and we're here to help make it happen.

Life Insurance for Women — Why It Matters More Than You Think

by Eric Seyboldt, MBA

Client: Eric, I thought life insurance was mostly for young families with kids. I’m a woman in my late 50s. Why would I need it now?

Eric: Great question. The assumption that life insurance is only for the young or the primary breadwinner is outdated. In reality, women—especially those nearing retirement—have five compelling reasons to consider a well-structured policy:

Longevity Risk - The Power of a Long-Term Care Rider

Women statistically outlive men by about five years. That’s both a gift and a planning challenge. A permanent life policy (like whole or universal life) can be used to help offset the cost of long-term care, supplement retirement income via policy loans, or fund a surviving spouse's expenses. Longevity means more years needing capital.Income Replacement (Yes, Still Relevant)

Even if you're no longer working full-time, your financial contributions matter. Are you providing childcare for grandkids? Handling bookkeeping for a spouse’s business? These unpaid roles would be costly to replace. A 10–20-year term policy costing $50–$150/month (based on age and health) could provide six figures in tax-free protection for those who rely on you, directly or indirectly.Wealth Transfer Efficiency

For women with significant assets—retirement accounts, real estate, or a family business—life insurance offers one of the most tax-efficient ways to transfer wealth. A permanent policy creates liquidity, sidestepping probate and potentially reducing estate tax burdens. Cost varies, but a $250,000 whole life policy for a healthy 60-year-old woman could run $3,000–$4,500 annually. The benefit: guaranteed cash value and tax-free death proceeds.Pension Maximization

Many pre-retirees are faced with choosing a reduced pension to provide survivor benefits for their spouse. Life insurance can be used as a hedge—take the higher pension option, and use a policy to replicate the survivor benefit. Often, a 15-year guaranteed level term policy is sufficient here. It’s actuarially sound planning, not just emotional comfort.Legacy and Charitable Giving

Women tend to be the philanthropic stewards of the family. A life insurance policy with a charity named as beneficiary ensures a meaningful, leveraged gift. A small annual premium—say, $1,000/year—can result in a six-figure benefit to a cause you care about. It’s a low-cost, high-impact strategy.

Client: So, how do I know which type of policy is right for me?

Eric: Here's a simple framework:

Temporary need (10–20 years) → Level Term Insurance (affordable, pure protection)

Permanent need (legacy, estate planning, long-term tax strategies) → Whole Life or Indexed Universal Life

Blended use (flexibility + investment growth) → Variable Universal Life (for the financially literate with appetite for market risk)

Client: What’s the next step?

Eric: We start with a conversation. We’ll look at your current financial position, your priorities, and what kind of outcomes matter most to you—whether that’s preserving independence, supporting a spouse, or creating a legacy. Life insurance isn't a product you buy; it's a strategy you tailor. And when done right, it’s one of the most efficient tools in the financial toolbox and a valuable asset class in your portfolio.

If this resonates with you—or even raises more questions than answers—let’s schedule time to talk. You’ve planned wisely your whole life. Let’s make sure your plan continues to work for you, not just today, but well into the future.

Contact us for a free, brief 10-minute consultation. Let's explore strategies to protect your wealth and make your retirement everything you've dreamed of—secure, fulfilling, and worry-free. Schedule a free 10-minute consultation today by calling 614-943-2265. Your future deserves the best plan, and we're here to help make it happen.

🧼 Ohio’s Most Trusted Name in Power Washing & Window Washing

Is your home’s curb appeal fading fast? You’re not alone—and there’s never been a better time to bring it back to life.

Right now, Luke’s Property Services is offering 10% OFF all power washing services—but only for a limited time (end of May)! Whether it’s your driveway, patio, deck, walkway, or siding, they’ll blast away years of grime in a single visit.

🏠 Before and after? Like night and day.

💧 Equipment? Commercial-grade and eco-friendly.

💪 Results? Shockingly clean—and they speak for themselves.

✅ Trusted by homeowners across Central Ohio

✅ Fast, professional, and always reliable

✅ No-pressure, free quotes — just text or call!

📞 Call or Text Luke’s Property Services Today: (614) 531-6979

Fixed annuities can be an essential component of a well-rounded retirement strategy, offering security, predictability, and efficiency in financial planning.

These are current fixed annuity rates and their durations from Top A-rated carriers (subject to change at any time, not FDIC insured):

Rates Are Maxing Out! Don’t Wait To Lock These Fixed Annuity Rates In Today! 6.70% is possible now!

3-year: 5.55% (under $100k Deposited)

3-year: 5.80% (over $100k Deposited)

5-year: 6.20% (under $100k Deposited)

5-year: 6.45% (over $100k Deposited)

7-year: 6.45% (under $100k Deposited)

7-year: 6.70% (over $100k Deposited)

Please feel free to call Eric at 614-943-2265 if you’d like to ask any questions or request information on these fixed annuities or other retirement topics that are on your mind.

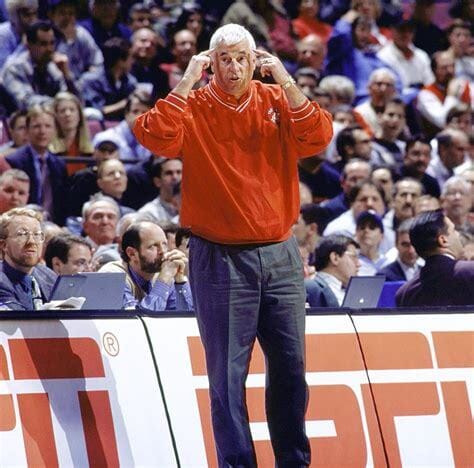

“The will to win is not nearly as important as the will to prepare to win.”

Coach Bobby Knight

Coach Bobby Knight

REAL ASSETS, Invest Like the Ultra-Wealthy

www.bourbon.fund

Invest Like the Ultra-Wealthy: Why Smart Money Is Flocking to Real Assets Like Gold—and Even Bourbon

Let’s call it like it is: the traditional retirement game plan is looking a little dated. Inflation keeps inching upward, the dollar isn’t packing the same punch, and central banks are flooding the system with cash like it’s open bar at a Monopoly tournament. Meanwhile, the markets? Volatile as ever.

That’s why the sharpest investors aren’t sitting around hoping for calm—they’re suiting up.

They’re turning to real assets—tangible, resilient investments that don’t vanish the moment Wall Street catches a cold. Think gold. Think bourbon barrels. Yes, bourbon. The same under-the-radar asset quietly building fortunes in high-net-worth circles.

These aren’t just collectibles—they’re financial body armor. Real-world assets that stand firm when equities wobble and paper gains go up in smoke.

It’s not merely a hedge. It’s a playbook for uncertain times.

📌 Gold has withstood centuries of financial upheaval.

📌 Bourbon barrels are aging assets with built-in appreciation and rising global demand.

📌 Physical assets provide something no stock ever can: ownership you can see, touch, and trade on your terms.

During market chaos, real assets don’t flinch. They thrive. History proves it. While equities tumble, hard assets often surge—shielding portfolios and delivering asymmetric returns when they're needed most.

And even in calm times? They add powerful diversification. That’s why the ultra-wealthy use them as a cornerstone—not a sideshow—in their wealth strategy.

Ask yourself:

🧠 Are you truly diversified?

🧠 What happens to your retirement if inflation stays elevated?

🧠 If the dollar weakens, what asset in your portfolio gets stronger?

If you don’t have a good answer, it’s time for a new conversation.

Allocating funds into the asset class known as “Real Assets” may be a strategy that you should consider.

Ask us how to Rollover a portion of Your IRA or 401k To A BOURBON IRA (www.bourbon.fund/how-it-works/) or a GOLD IRA (see link below) and:

Safeguard your assets from the collapsing dollar

Incorporate the ‘REAL ASSET’ class into your portfolio like the ultra-wealthy

Hedge against the current high-inflation conditions

Protect your retirement assets against economic crises

Just get in touch. We make it easier than ever.

CONNECT WITH US

Eric Seyboldt, MBA

Feedback or Questions?

You’re invited to get in touch with us if you’d like to find out how the Novus Financial Group can help you on your journey to a happy, fulfilling life in Retirement.

Office: 614-943-2265

Feel Free To Forward Retirement Examined To A Friend and Have Them Subscribe By Clicking The Button Below:

Reach out if you’d like to advertise your business on Retirement Examined or would like to be a sponsor.

Investment advisory services are offered by duly registered individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser.

The content we provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision. Also, note that every investment comes with its risks and drawbacks. Lastly, we would like to remind you that past results cannot guarantee future returns.

This website contains one affiliate link. When you click on the link and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers