- Retirement Examined

- Posts

- Retirement Examined

Retirement Examined

5-Minutes Of News, Strategies, & Tips

The weekly email that keeps you up to date on exciting Retirement topics in an enjoyable, entertaining way for free.

Shocking Betrayal: How a Home Health Worker Stole Real Estate from the Vulnerable

by Eric Seyboldt

In the heart of Miami, a grave scenario reveals the pressing vulnerabilities facing our retired elderly and disabled populations. A distressing incident involved a home healthcare worker taking advantage of an elderly woman and her disabled son in Little Havana, defrauding them of their property. This case, alongside others like it, underscores the urgent need for robust strategies to protect retirees and vulnerable community members from scams.

In a flagrant abuse of trust, Dahamara Cuervo Alonso, a 48-year-old healthcare worker from a reputed service agency, was assigned to care for a family facing significant health challenges. The family, comprising a 51-year-old son and his 86-year-old mother suffering from cognitive impairments, tragically fell victim to a real estate fraud orchestrated by Alonso. She deceitfully convinced them to sign over their apartment, effectively robbing them of their ownership.

Miami-Dade State Attorney Katherine Fernandez Rundle highlighted how property owners, even those who own their homes outright, can become prime targets for fraudsters. The son’s discovery of the crime through a quit claim deed fraud video on YouTube led to the shocking realization that their property had been surreptitiously transferred to Alonso. Leveraging the family's linguistic barriers, as they were non-English speakers, Alonso manipulated them into signing documents purported to verify her work hours. Her charges now include the exploitation of the elderly, grand theft, and executing a detailed scheme to defraud.

The Similar Tale of the Johnston Family

Echoing the Miami case, another incident occurred in Phoenix, Arizona, involving the elderly Johnston couple. A fraudulent financial advisor gained their trust through regular home visits under the guise of helping with financial planning. Over time, he persuaded them to sign what he falsely claimed were routine financial documents. It was only after their daughter reviewed these papers, following suspicious bank statements, that the couple realized they had unwittingly signed over their home.

Effective Measures to Combat Real Estate Fraud Against the Elderly:

Increased Education and Awareness

To combat the scourge of real estate fraud, education remains a critical shield. Regular workshops and information sessions could significantly enhance understanding among retirees about the potential scams lurking and emphasize the critical importance of thoroughly reviewing every document before signing.

Stronger Verification Processes for Healthcare Workers

The introduction of rigorous background checks and frequent audits for home healthcare workers can act as a deterrent against potential fraudsters. Ensuring transparency and accountability within home care services is vital to protecting our seniors.

Accessible Legal and Financial Counseling

Providing retirees with easy access to free or low-cost legal and financial counseling can be a game-changer. These services offer a crucial second opinion on important documents and transactions, empowering the elderly to make informed decisions safely.

The harsh reality of these fraud cases serves as a wake-up call to strengthen our efforts in protecting the financial security and well-being of vulnerable populations. Through the diligent pursuit of justice for victims and proactive preventative measures, we can secure a safer future for our retirees, ensuring they are shielded from the clutches of exploitation. By uniting as a community and implementing these strategic protections, we can stand as a formidable barrier against fraud, safeguarding the rights and homes of those most in need.

Reach out to us for a complimentary, 10-minute consultation call. Let's explore together how we can help you protect your assets, ensuring your golden years are as fulfilling and worry-free as you’ve always imagined. Email Eric at [email protected] or give us a call today to schedule your consultation. Let's make your retirement dreams a reality!

Client Q & A of the Week - I Retired, Now What?

Client: Mark, I was mostly a do-it-yourselfer when I was building up my 401k. Now that I’m retired, how should I invest my retirement funds?

Mark: Congratulations on your success.

Embracing retirement is a significant milestone that brings about a shift in how you manage your finances. To ensure a stable and satisfying retirement, crafting a financial strategy that adapts to your personal needs and prevailing market conditions is essential. As we navigate through the complexities of the economic landscape in May 2024, let's explore the key components of a successful retirement investment plan that aims to protect your assets and cater to your life goals.

Prioritizing Capital Preservation

At the heart of a robust retirement plan is the goal of capital preservation, complemented by income generation that aligns with your living expenses and inflation considerations. For retirees, the focus should generally lean towards securing financial stability rather than chasing potentially high returns accompanied by greater risks. This balanced approach helps shield your savings while providing the necessary funds to maintain your lifestyle.

Diversifying Your Investment Portfolio

With interest rates remaining high, traditional investment options like bonds currently yield less. Hence, diversifying your investments becomes crucial. A well-rounded portfolio should include a combination of Real Assets (like Bourbon & Precious Metals), equities, and other asset classes. Equities, particularly those from companies with a history of stable and consistent dividends, are vital for growth and help protect your finances from inflation.

Exploring Real Estate and Dividends

Consider integrating Real Estate Investment Trusts (REITs) and high-dividend stocks into your portfolio. These assets not only yield regular income but also historically act as a hedge against inflation. However, it's important to balance these with assets that contribute to liquidity and reduce overall volatility.

Incorporating Guaranteed Income Sources

For additional security, exploring guaranteed income sources like annuities is advisable. Fixed annuities, for instance, can provide a reliable income stream, particularly valuable during uncertain market phases. This can offer considerable peace of mind to retirees seeking to protect their financial basis against unpredictable economic conditions.

Emphasizing Flexibility in Planning

The importance of maintaining flexibility within your retirement plan cannot be overstressed, especially in the context of a post-pandemic economic recovery that may bring unforeseen challenges. Adapting your investment strategy in response to shifts in the economic landscape and your personal circumstances is critical for protecting your retirement funds.

Consulting with a Financial Advisor

Lastly, partnering with a financial advisor, such as Novus Financial Group, can prove invaluable. A skilled advisor can offer tailored advice and insights into portfolio management, tax implications, and estate planning, helping you navigate through the complexities with ease.

Your retirement should be a period of relaxation and enjoyment, free from financial worries. By designing a thoughtful and adaptable investment strategy, you can protect your financial well-being and enjoy the rewards of your years of hard work. Engage with professional advisors, focus on stable investments, and prepare for a future that supports both your financial security and personal aspirations.

Reach out to us for a complimentary, 10-minute consultation call. Let's explore together how we can assist you in optimizing your retirement income and protecting your wealth to ensure that you are living your best life in retirement. Email Mark at [email protected] or give us a call (614-214-6668) today to schedule your consultation.

Fixed annuities can be an essential component of a well-rounded retirement strategy, offering security, predictability, and efficiency in financial planning.

Here are current fixed annuity rates and their durations from Top A-rated carriers (subject to change at any time, not FDIC insured):

Rates Have Increased! Don’t Wait To Lock Them In!

3-year: 5.70% (under $100k Deposited)

3-year: 5.85% (over $100k Deposited)

5-year: 5.95% (under $100k Deposited)

5-year: 6.30% (over $100k Deposited)

Please feel free to email Eric at [email protected] if you’d like to ask any questions or request information on these fixed annuities or other retirement topics that are on your mind.

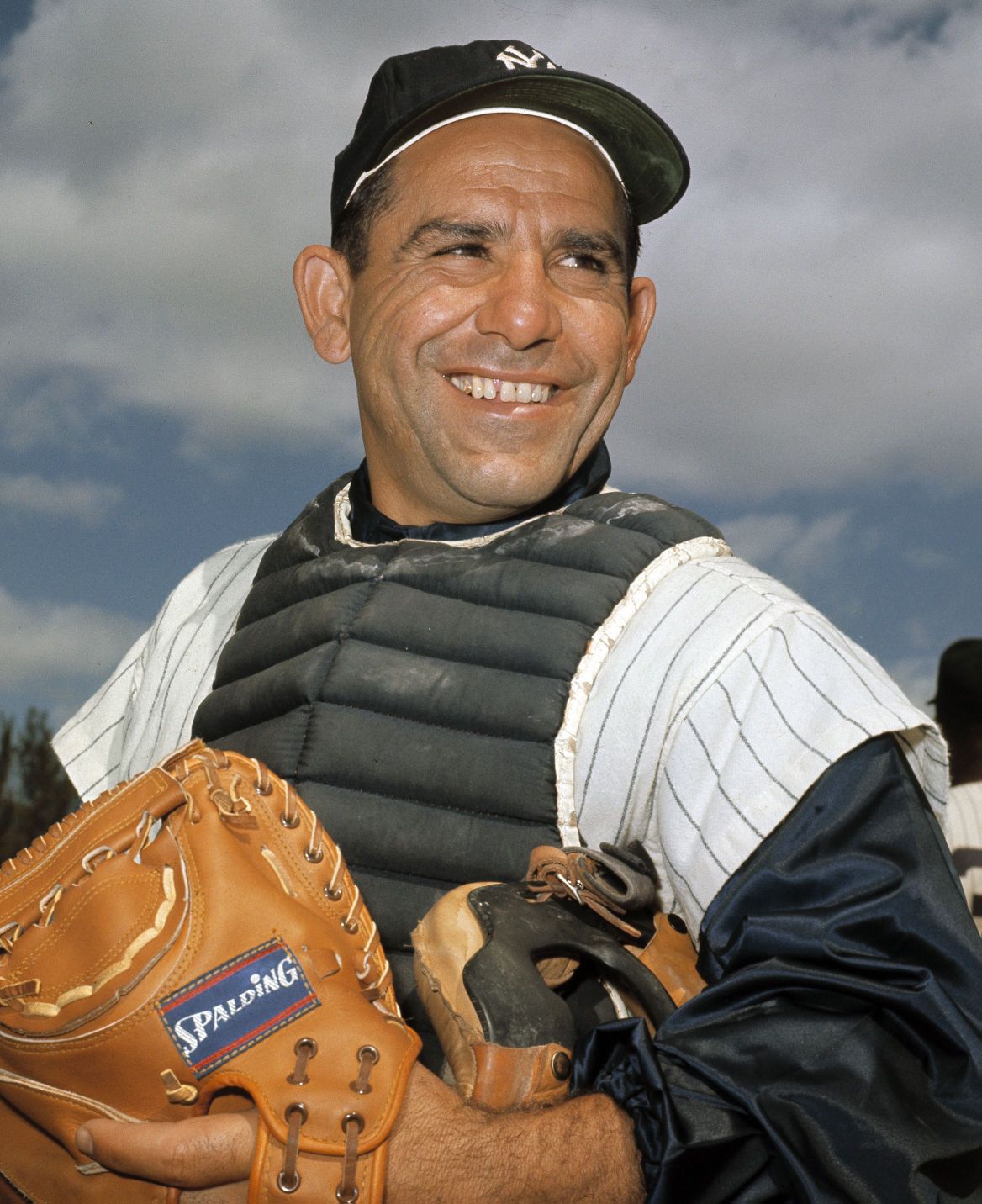

“If You Don’t Know Where You’re Going, You Might Wind Up Someplace Else.”

Yogi Berra

REAL ASSETS, Invest Like the Ultra-Wealthy

The Bourbon Reserve; www.bourbon.fund

Inflation Is Rising and The Government Wants to Print Even More Money

As The US Dollar faces a historic downturn, and inflation climbs to levels unseen in decades, many Americans are urgently seeking effective strategies to safeguard their retirement funds against the tempest of today's economic and geopolitical turbulence!

Amid concerns ranging from spiraling debt limits and soaring interest rates to unprecedented government spending and the erratic behavior of financial markets, navigating your financial future can feel, like choosing between the lesser of many evils? But what if there was a way to not just navigate but thrive?

A growing number of savvy investors are turning to tangible assets as a bulwark against economic uncertainty. Whether it’s converting part of your IRA or 401(k) into physical gold or even, barrels of Bourbon; these real assets offer a compelling, protective strategy?

During periods of loose monetary policies and inflation spikes or even in economic downturns, Real Assets like Gold and Bourbon have historically outperformed! They not only offer a hedge against crises but also present an excellent diversification opportunity in more stable times.

Considering the volatile state of today's economy, investing in the “Real Assets” category could be the strategic move to fortify your financial future! Ready to explore how these tangible assets can enhance your Investment Portfolio? Let’s connect to pave your path to a more secure and Prosperous retirement.

Allocating funds into the asset class known as “Real Assets” may be a strategy that you should consider.

Ask us how to Rollover a portion of Your IRA or 401k To A BOURBON IRA (www.bourbon.fund/how-it-works/) or a GOLD IRA (see link below) and:

Safeguard your assets from the collapsing dollar

Incorporate the ‘REAL ASSET’ class into your portfolio like the ultra-wealthy

Hedge against the current high-inflation conditions

Protect your retirement assets against economic crises

Just get in touch. We make it easier than ever.

CONNECT WITH US

Eric Seyboldt, MBA, Co-Founder & Managing Director of Novus Financial Group

Mark McCanney, Co-Founder and President of Novus Financial Group

Feedback or Questions?

You’re invited to get in touch with us if you’d like to find out how the Novus Financial Group can help you on your journey to a happy, fulfilling life in Retirement.

We have a lot of great information, as well as podcasts from our radio show ‘The Financial Insider’, and tools on our website - www.novusfg.com.

Office: 614-943-2265

Feel Free To Forward Retirement Examined To A Friend and Have Them Subscribe By Clicking The Button Below:

Reach out if you’d like to advertise your business on Retirement Examined or would like to be a sponsor.

Investment advisory services are offered by duly registered individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Novus Financial Group are unaffiliated entities.

The content we provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision. Also, note that every investment comes with its risks and drawbacks. Lastly, we would like to remind you that past results cannot guarantee future returns.

This website contains one affiliate link. When you click on the link and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers