- Retirement Examined

- Posts

- Retierment Examined

Retierment Examined

5-Minutes of Breakthrough Secrets: Happy, Fulfilling Retirement

The weekly email that keeps you up to date on exciting Retirement topics in an enjoyable, entertaining way for free.

Addressing Top Financial Challenges and Risks

by Eric Seyboldt

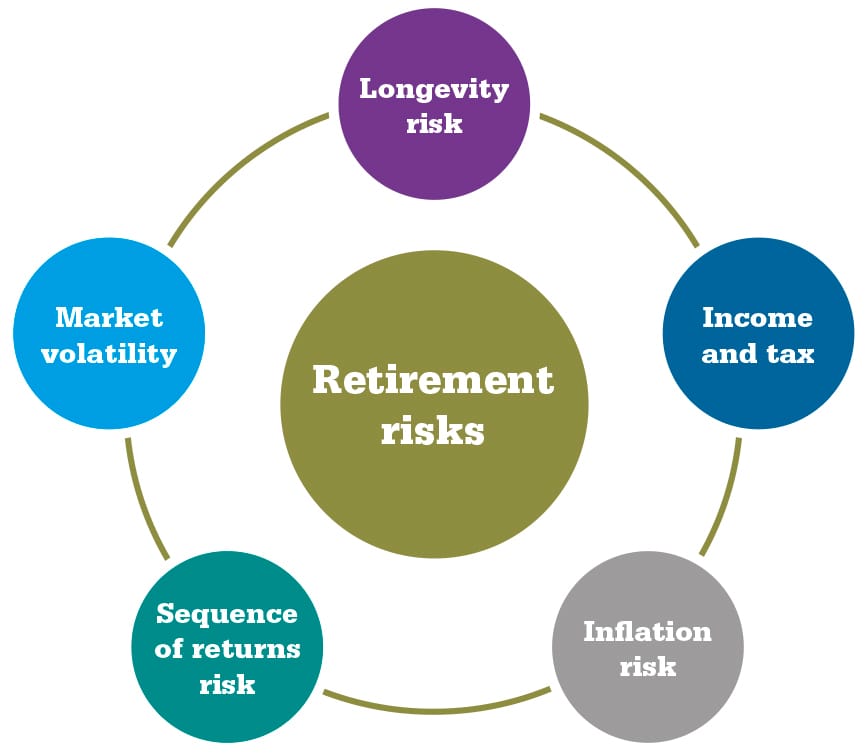

Retirement should be a time of peace and fulfillment, yet it often comes with significant financial challenges and risks. Understanding and planning for these hurdles is crucial to sustain a comfortable and secure retirement lifestyle. Here are five critical financial challenges that retirees face in today's economic climate and strategies to manage them effectively.

Traditionally, bonds have been a popular choice for retirees looking for steady income streams. However, the current high-interest rate climate has led to lower bond prices and subsequently, reduced returns. This change requires retirees to reassess their investment strategies and risk tolerance in order to preserve capital while still generating necessary income. Adapting investment portfolios to include a diversified range of assets might better align with financial goals during retirement.

2. Overcoming Longevity Risk

With advancements in healthcare and overall lifestyle improvements, life expectancy is on the rise. While this is positive news, it also introduces longevity risk, where retirees might outlive their retirement savings. This risk necessitates meticulous management of finances to ensure that savings stretch for potentially several decades. Incorporating lifelong financial planning and possibly annuity investments can be vital to mitigate this risk.

3. Managing Healthcare Expenses

As we age, healthcare becomes increasingly necessary and expensive, representing one of the largest categories of expenditure for retirees. Medicare offers critical coverage but does not encompass all healthcare costs, particularly long-term care. Planning for unexpected healthcare expenses is essential and can involve setting aside specific savings or investing in supplemental insurance to safeguard against rapidly depleting retirement funds due to medical bills.

4. Countering Inflation Impact

Inflation significantly affects purchasing power, which can severely impact a retiree's ability to sustain their desired standard of living. Given that expenses in categories such as healthcare and housing frequently rise at rates above general inflation, it's important to consider these effects in retirement planning. Strategies such as investing in inflation-protected securities and Real Assets, or structuring a withdrawal strategy that accounts for inflation, can help protect financial stability.

5. Dealing with Market Volatility

Market volatility presents a dual threat in retirement: the need for asset growth to offset inflation and the risk posed by potential market downturns. Despite the lure of high returns, unpredictable market declines can swiftly erode a retirement portfolio's value. To combat this, retirees should focus on portfolio diversification and regular rebalancing, which can buffer against the impact of market fluctuations and align investments with changing risk profiles.

Conclusion

Facing these retirement challenges and risks head-on with proactive and comprehensive planning can alleviate their potential impact. Retirees are encouraged to consult financial advisors, stay abreast of economic trends, and continually adapt their strategies accordingly. With thoughtful preparation, the journey through retirement can be navigated with confidence and security, ensuring a stable and enjoyable phase of life.

Reach out to us for a complimentary, 10-minute consultation call. Let's explore together how we can help you protect your assets, ensuring your golden years are as fulfilling and worry-free as you’ve always imagined. Email Eric at [email protected] or give us a call today to schedule your consultation. Let's make your retirement dreams a reality!

Keep up with AI

How do you keep up with the insane pace of AI? Join The Rundown — the world’s largest AI newsletter that keeps you up-to-date with everything happening in AI, and why it actually matters in just a 5-minute read per day.

Client Q & A of the Week - When Should I Claim Social Security?

Client: Eric, I’m torn. Should I start taking Social Security Benefits when I turn 62 or should I wait until I hit “Full Retirement Age (FRA)”?

Eric: Making the decision about when to start receiving Social Security benefits is a pivotal milestone in retirement planning, demanding a thorough understanding of one's individual circumstances and aspirations.

It's crucial to grasp the implications of initiating benefits as early as age 62 versus waiting until you reach your Full Retirement Age (FRA). Opting for benefits at 62 results in a reduced monthly payment, often around 30% less than if one waits until FRA. Conversely, delaying benefits past FRA can yield progressively higher monthly payments, peaking at age 70.

In contemplating these choices, it's essential to assess a myriad of factors, each deeply intertwined with one's unique life journey. Financial stability takes center stage. For those relying on immediate funds to meet daily needs or lacking alternative income streams, starting benefits early may offer much-needed relief, even with the trade-off of lower payments.

Conversely, individuals blessed with financial security may deliberate deferring benefits, viewing it as an investment in a more robust financial future during retirement. This decision can substantially enhance monthly payments, enhancing overall quality of life and providing greater peace of mind.

Health status plays a pivotal role as well. Those anticipating a longer, healthier life or with a familial history of longevity might find merit in delaying benefits and optimizing lifetime earnings. Conversely, individuals confronting health challenges may prioritize immediate financial support, maximizing benefits during their lifetime.

Furthermore, the impact on spousal benefits should not be underestimated. Coordinating benefit-claiming strategies with a partner can optimize total benefits for the household, ensuring a secure financial foundation for both spouses, even in the event of one's passing.

Ultimately, there is no one-size-fits-all solution. Each individual's journey is unique, necessitating a personalized approach and thorough evaluation. As a seasoned expert in retirement planning, I emphasize the importance of informed decision-making, tailored strategies, and, when necessary, seeking guidance from professionals to embark on this crucial aspect of retirement planning with confidence and clarity, enriching one's golden years with financial security and peace of mind.

Reach out to us for a complimentary, 10-minute consultation call. Let's explore together how we can assist you in optimizing your retirement income and protecting your wealth to ensure that you are living your best life in retirement. Email Eric at [email protected] or give us a call (614-943-2265) today to schedule your consultation.

Fixed annuities can be an essential component of a well-rounded retirement strategy, offering security, predictability, and efficiency in financial planning.

Here are current fixed annuity rates and their durations from Top A-rated carriers (subject to change at any time, not FDIC insured):

Rates Increased Last Week! Don’t Wait To Lock Them In!

3-year: 5.50% (under $100k Deposited)

3-year: 5.85% (over $100k Deposited)

5-year: 5.95% (under $100k Deposited)

5-year: 6.30% (over $100k Deposited)

Please feel free to email Eric at [email protected] if you’d like to ask any questions or request information on these fixed annuities or other retirement topics that are on your mind.

“The whole problem with the world is that fools and finatics are always so certain of themselves, and wiser people so full of doubts.”

Bertrand Russell and his children John and Katharine

REAL ASSETS, Invest Like the Ultra-Wealthy

The Bourbon Reserve, www.bourbon.fund

Exploring Real Assets as a Defensive Strategy

Amidst the unpredictable economic climate, an increasing number of astute investors are looking toward tangible assets to shield their retirement savings. Assets such as physical gold, or even unconventional choices like barrels of a great American product like Bourbon, are becoming popular choices. These Real Assets are not merely safeguards in times of monetary easing and inflationary spikes, they also stand as robust diversification options even during stable periods.

Real Assets have a historical track record of outperforming other investment avenues during economic downturns, providing a sturdy hedge against potential crises. For anyone considering a fortified approach to securing their financial future, integrating Real Assets into your investment portfolio could be a wise and lucrative move.

Considering the volatile state of today's economy, investing in the “Real Assets” category could be the strategic move to fortify your financial future! Ready to explore how these tangible assets can enhance your Investment Portfolio? Let’s connect to pave your path to a more secure and Prosperous retirement.

Allocating funds into the asset class known as “Real Assets” may be a strategy that you should consider.

Ask us how to Rollover a portion of Your IRA or 401k To A BOURBON IRA (www.bourbon.fund/how-it-works/) or a GOLD IRA (see link below) and:

Safeguard your assets from the collapsing dollar

Incorporate the ‘REAL ASSET’ class into your portfolio like the ultra-wealthy

Hedge against the current high-inflation conditions

Protect your retirement assets against economic crises

Just get in touch. We make it easier than ever.

CONNECT WITH US

Eric Seyboldt, MBA, Co-Founder & Managing Director of Novus Financial Group

Mark McCanney, Co-Founder and President of Novus Financial Group

Feedback or Questions?

You’re invited to get in touch with us if you’d like to find out how the Novus Financial Group can help you on your journey to a happy, fulfilling life in Retirement.

We have a lot of great information, as well as podcasts from our radio show ‘The Financial Insider’, and tools on our website - www.novusfg.com.

Office: 614-943-2265

Feel Free To Forward Retirement Examined To A Friend and Have Them Subscribe By Clicking The Button Below:

Reach out if you’d like to advertise your business on Retirement Examined or would like to be a sponsor.

Investment advisory services are offered by duly registered individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Novus Financial Group are unaffiliated entities.

The content we provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision. Also, note that every investment comes with its risks and drawbacks. Lastly, we would like to remind you that past results cannot guarantee future returns.

This website contains one affiliate link. When you click on the link and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers